the new art season. At auction houses in London and New York, sellers are preparing to bail on their investments after the emerging-art bubble burst and the resale market for once sought-after artists dried up.

That $100,000 Painting Bought to Flip Is Now Worth About $20,000

Updated on

- Emerging names discounted most as art crash foils speculators

Art dealer and collector Niels Kantor paid $100,000 two years ago for an abstract canvas by Hugh Scott-Douglas with the idea of quickly reselling it for a tidy profit. Instead, he is returning the 28-year-old artist’s work to the market this week at an 80 percent discount.

Such is the new art season. At auction houses in London and New York, sellers are preparing to bail on their investments after the emerging-art bubble burst and the resale market for once sought-after artists dried up.

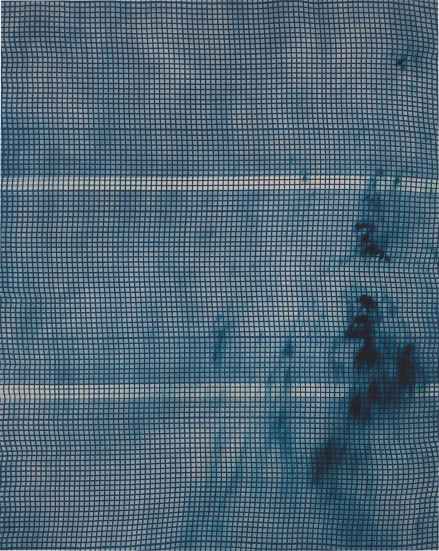

Untitled by Hugh Scott-Douglas

Source: Phillips

“I’d rather take a loss,” said Kantor, who is offering the Scott-Douglas work at the Phillips auction in New York on Sept. 20. “I feel like it can go to zero. It’s like a stock that crashed.”

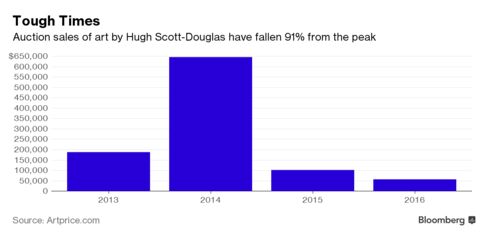

Prices for works by young artists such as Scott-Douglas and Lucien Smith soaredwith the auction market in 2014, sometimes reaching hundreds of thousands of dollars, when they were traded like bull-market tech stocks. But since auction sales began to drop in late 2015, the emerging names have been hit especially hard. Sales by some artists are down 90 percent or more as the glut of work and nosebleed prices scare away buyers.

That’s because speculators purchase art to resell it, not to keep it.

‘Economics 101’

“When those speculators realize that there is no end user at a higher price, then they scramble to sell the work before they lose everything,” said Todd Levin, director of Levin Art Group, who advises collectors. “The demand is driven by greed, the selloff by fear. It’s Economics 101.”

Today’s market is a far cry from a few years ago, when young artists churning out process-based abstrac

- Market is undergoing a painful but ‘much-needed’ readjustment

t work presented opportunities for outsize returns.

The works were often created by artists still in their 20s. Smith saw a painting he made while an undergraduate at New York’s Cooper Union fetch $389,000 at Phillips in 2013, two years after it was purchased for $10,000.

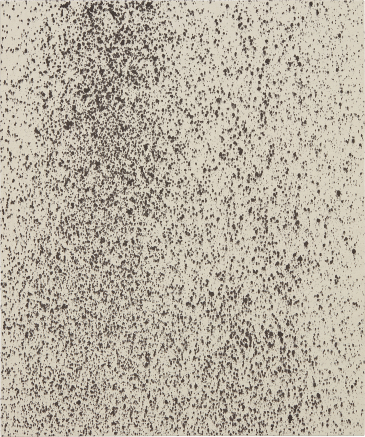

Bewitched, Bothered, and Bewildered 3 by Lucien Smith

Photographer: CLX Europe

This week, estimates for three Smith pieces are as low as $7,000. One, from the series he made by spraying more than 200 canvases with paint from a fire extinguisher, is estimated at $12,000 to $18,000. A bigger spray work sold for $372,120 two years ago.

“This whole year has been a big readjustment, a much-needed one, like a chiropractic session,” said Timothy Blum, co-owner of Blum & Poe Gallery in Los Angeles, New York and Tokyo. “It can hurt, but you come out on the other end better than before.”

Scott-Douglas’s untitled canvas, one of several resembling a sheet of blueprint grid paper, is estimated at $18,000 to $22,000 at Phillips’s “New Now” sale. The work was part of the artist’s sold-out exhibition at Blum & Poe in 2013, when it garnered $25,000.

‘Drunk’ Traders

Kantor acquired the work privately in July 2014. Four months later, a similar piece from the series went for $100,000 at Christie’s. Kantor expected the prices to keep surging, but in February 2015 another canvas from the same series failed to sell at auction.

“I feel like we were a little bit drunk and didn’t think of the consequences,” he said. “Then the bottom fell out. Everyone got stuck with their pants down.”

Before consigning his piece to Phillips, Kantor tried selling it privately for a year -- through Blum & Poe, the work’s former owner, even on EBay. At one point he was asking $50,000 but couldn’t get an offer.

“There are certainly some cases where people have paid more at the height of the market,” said Rebekah Bowling, head of the Phillips sale. “We are in a market where we have to be conservative. Everyone is very price conscious.”

As a result, auction estimates often not only are down from the heyday, but also below primary market prices. At Phillips, more than half of the 204 lots are estimated below $10,000.

“No one is folding tent because auction prices have declined,” said Casey Kaplan, whose gallery is opening the artist’s solo exhibition in New York next month. Prices for fresh works by Scott-Douglas range from $25,000 to $80,000.

There are several reasons to sell low, according to Kantor.

‘Supply Chain’

“Some people are looking for a tax loss. Some people didn’t pay much. Some people bought for an investment,” he said from Los Angeles. “These are large works. You are paying storage and insurance.”

Unwound Rope Wall Piece by Dodd

Source: Phillips

Keeping estimates modest could help set up a new bullish cycle, said Stefan Simchowitz, the Los Angeles entrepreneur known for buying in bulk from young artists on behalf of clients and for his own collection.

“I am going to be extremely active in the auction market as a seller and a buyer,” said Simchowitz, who owns 3,500 artworks.

At Phillips, Simchowitz is parting with a piece by Lucy Dodd, an artist he said he isn’t able to collect in depth. The work, made of rope strands hanging off a horizontal wooden bar like a curtain, may bring $10,000 to $15,000. Dodd’s auction record of $37,500 was set in May, shortly after the Whitney Museum of Art displayed her large-scale paintings made with materials such as fermented walnuts.

“I want to create a supply chain of work at lower price points so that people can come in again and start buying opportunistically,” Simchowitz said. “People can say: ‘I don’t have to worry about losing this money.”’

Comments

Post a Comment